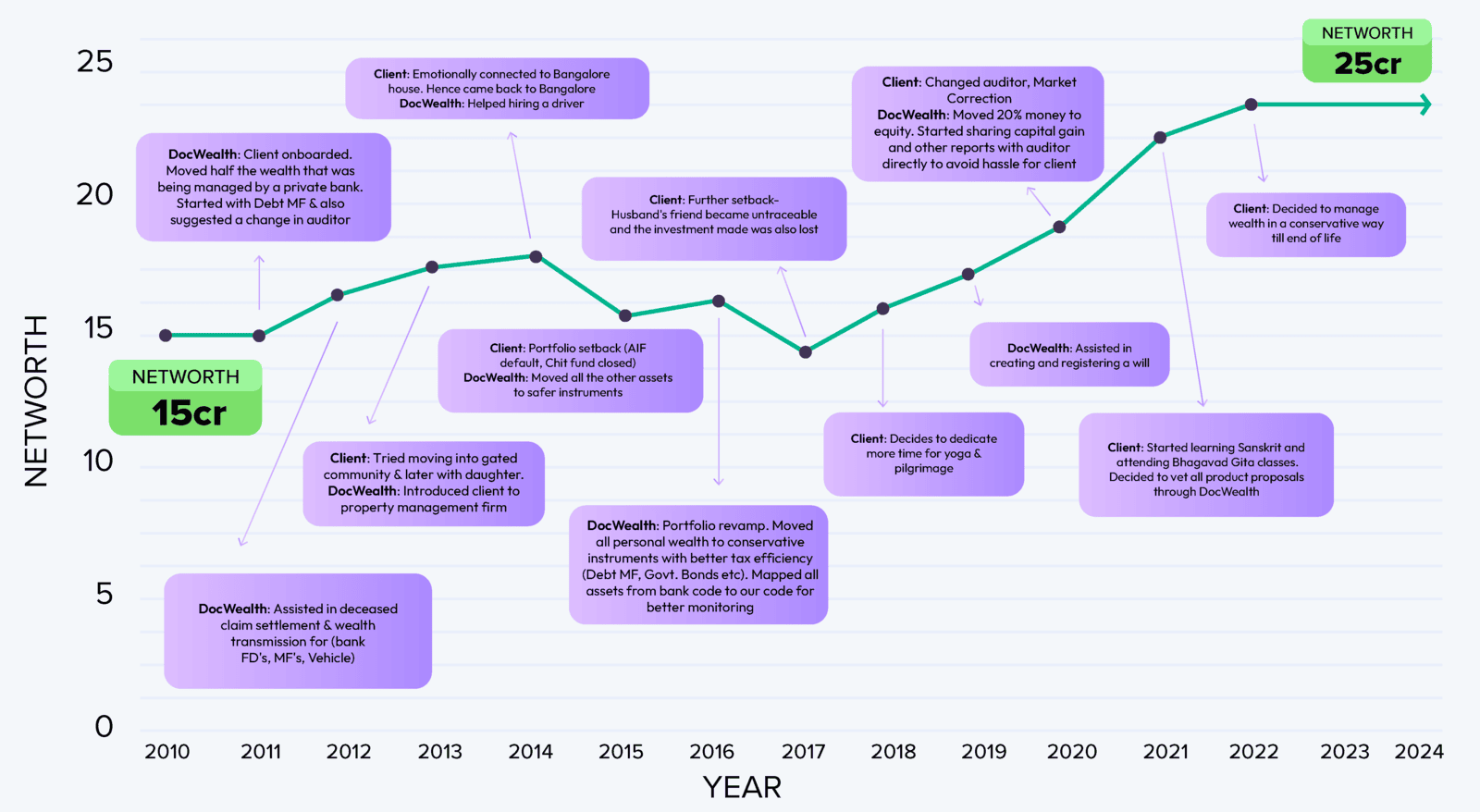

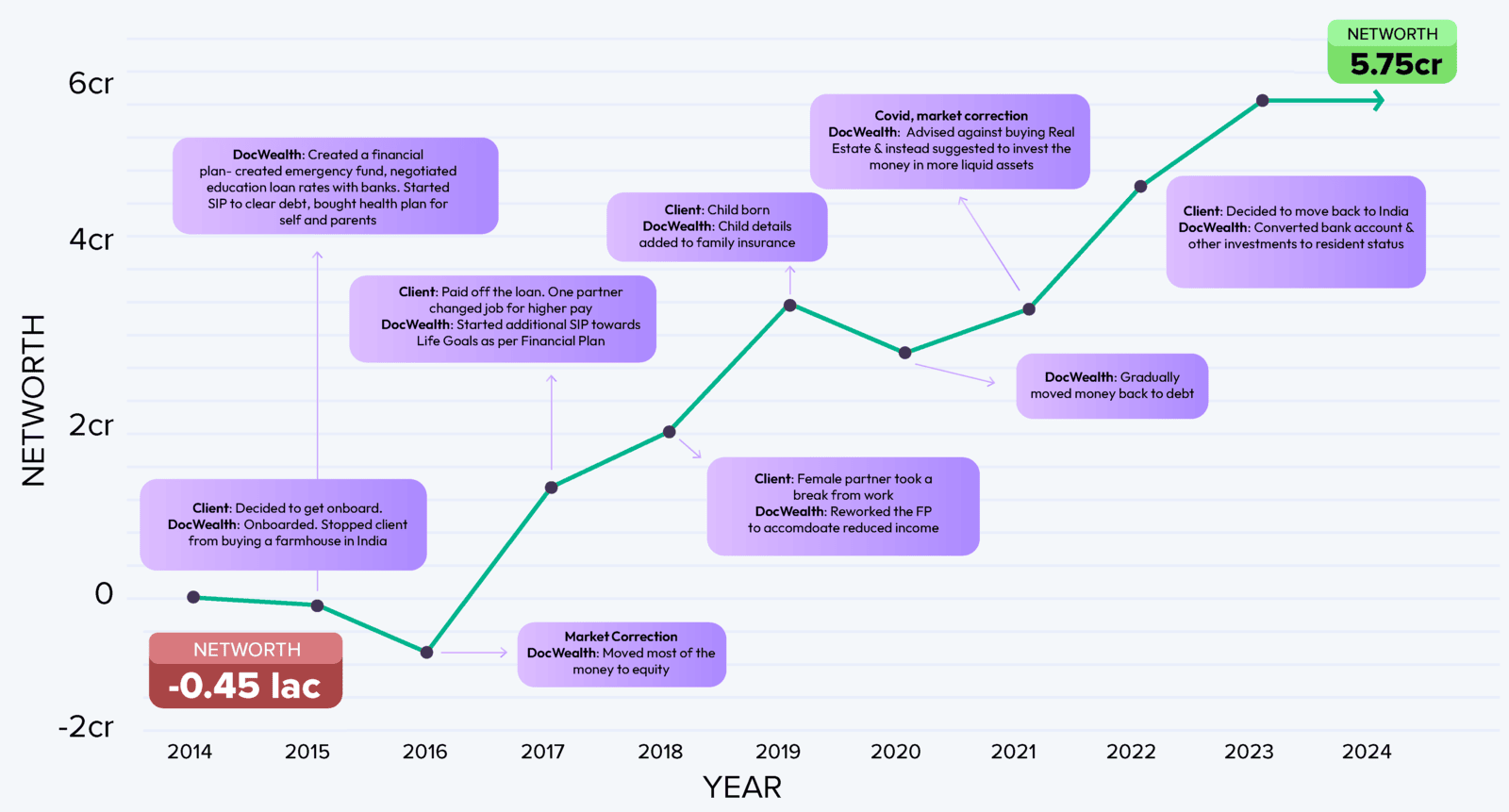

Conservative investor overcoming setbacks

Conservative investor overcoming setbacks

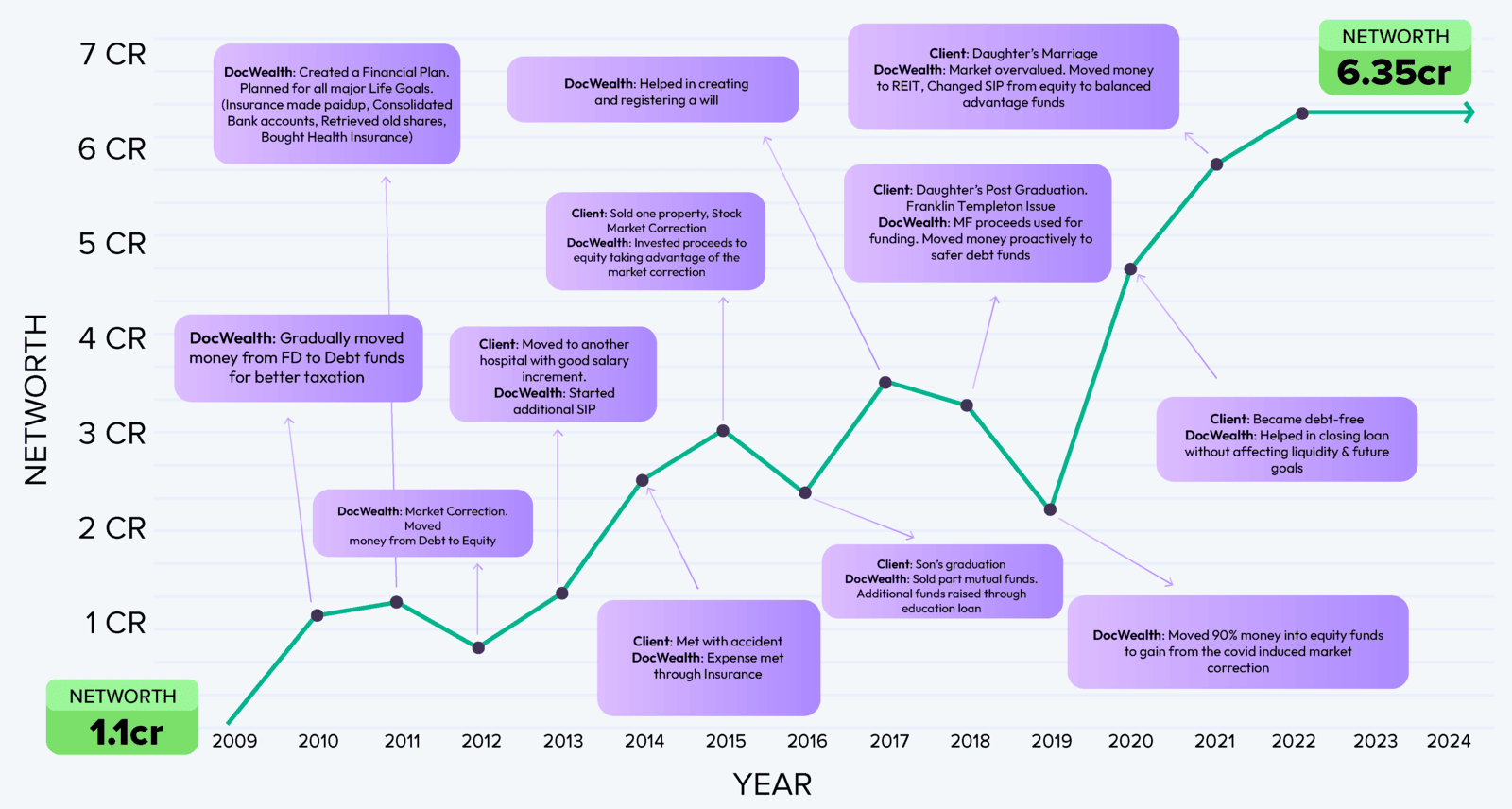

The ambitious, disciplined investor

The ambitious, disciplined investor

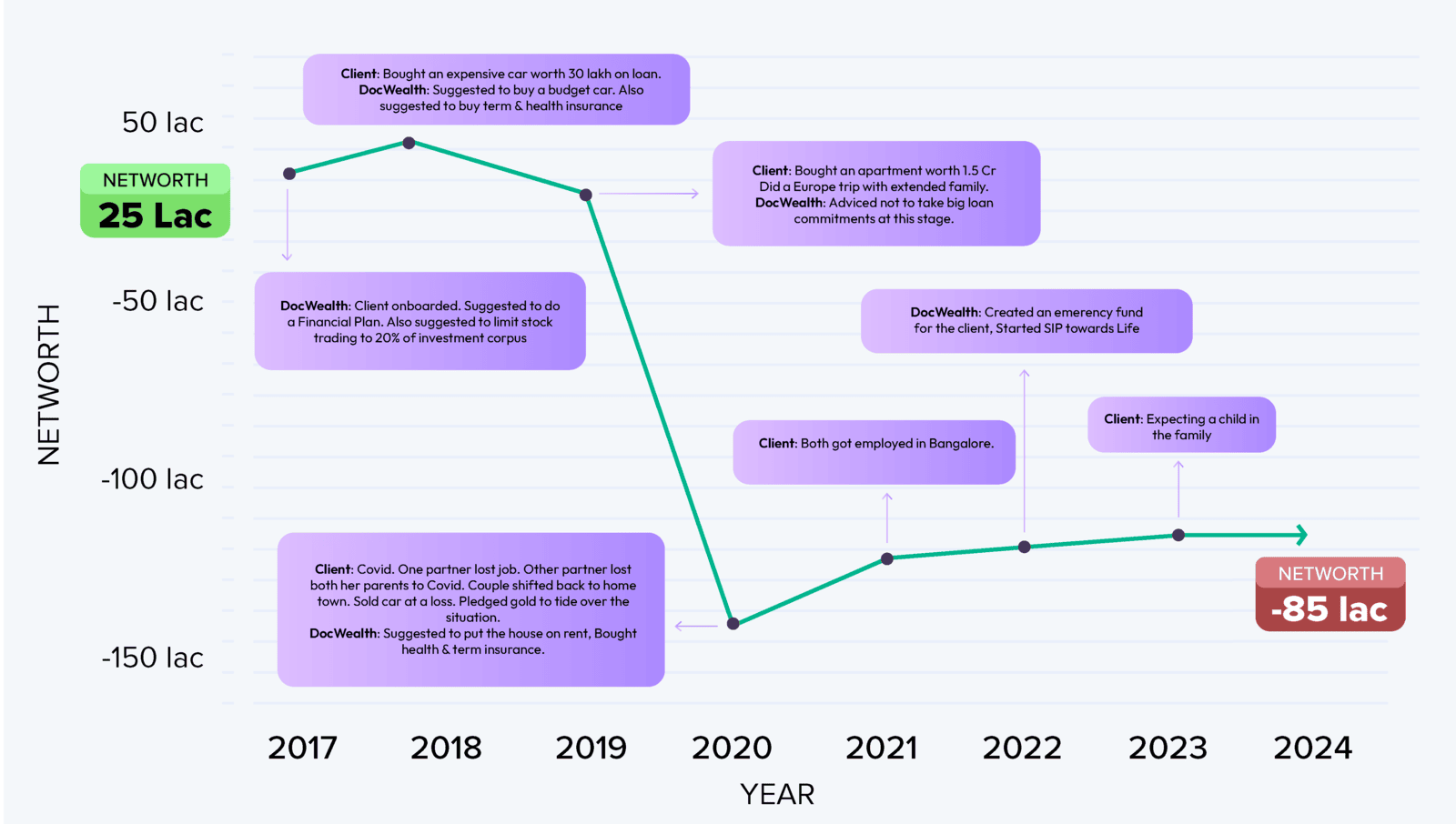

Unheeded advice, unsavory results

Unheeded advice, unsavory results

Sticking to the plan

Sticking to the plan

Dr. Murali Chakravarthy

I know Mr Siju Nair from his Axis Bank days when he was servicing all Fortis Hospital doctors. I chose Doctors' Wealth Advisors, because of their client-centric approach. My investments are doing quite well. Not only has the firm fulfilled the assured targets, but also gave me the ideas to better them. I would gladly recommend Mr Siju Nair to my fellow doctor colleagues, and indeed the whole wide world.

Dr MG Bhat

Their financial advice is great, there can be no doubt. My portfolio has managed to suffer all ups and downs of the market and I am a satisfied investor. They always meet me with a smile, and I am always waiting for the meetup days I have set with them. Such positivity, such a good vibe I get when I meet Rajiv & Siju. They are my friends and wellwishers first, advisors second. I highly recommend them.

Dr. Nandhini Ravindran

I was referred to Doctors' Wealth Advisors for their extensive experience in creating wealth for people in the medical field. But I stayed for their ability to professionally create a feeling of trust. I can wholeheartedly recommend them to anyone seeking better control of their finances and have an increased feeling of security and peace of mind.

Dr. Pradip Abraham

We got in touch through LinkedIn. I initially had a lot of doubts as to which investments were best for me. I kept asking and the team at Doctors' Wealth Advisors kept addressing my concerns. We spoke continuously for many months, the trust developed and I decided that these are the advisors I am going to trust to grow my wealth.

Dr. Joseph Xavier

I have followed their journey since the beginning. The firm that first helped me sort out my paperwork issues now handles much of my investments and has also made an estate plan for my wife. I trust them. They have great leadership and the team continues to grow. Highly recommend them.

Dr. Sophia Arshi

Getting in touch with Siju through LinkedIn was a blessing in disguise. Not many financial advisors can understand the logic of ethical investments. I am very pleased that my advisors not only understand but appreciate and uphold my choice of investments that align with my values. I wish Doctors' Wealth Advisors the best in their journey to help more doctors make good investment decisions.

Dr Dilip and Dr Sharon

When we started focusing on our finances, we were going to do normal investments like real estate and gold. Connecting with Doctors' Wealth Advisors helped us understand the better options for securities investments. We had many doubts at first. But the team at DWA helped us navigate every question we had and then we made a financial plan. We are very happy with the results.

Dr. Nisha Vishnu

I had heard a lot about Doctors' Wealth Advisors through our colleagues. But I was skeptical about trusting someone with our hard-earned finances. But Siju and Rajiv showed us that they are both good human beings and good financial advisors. With them, my husband and I understood our goals and created a financial plan. I have many times in the past and continue to recommend this firm to all doctors.

Phases in a doctor’s financial journey

Young Doctors:

Start-up Phase

Paying off student loans, budgeting for further education, and generating alternate sources of income.

Middle-Aged Doctors: Peak Earning Phase

Debt repayment, tax planning, cash flows, independent practice, and indemnity insurance.

Pre-Retirement Doctors: Cooling-off Phase

Retirement planning, spending plan, real estate portfolio, estate plan, and philanthropy.