Founders

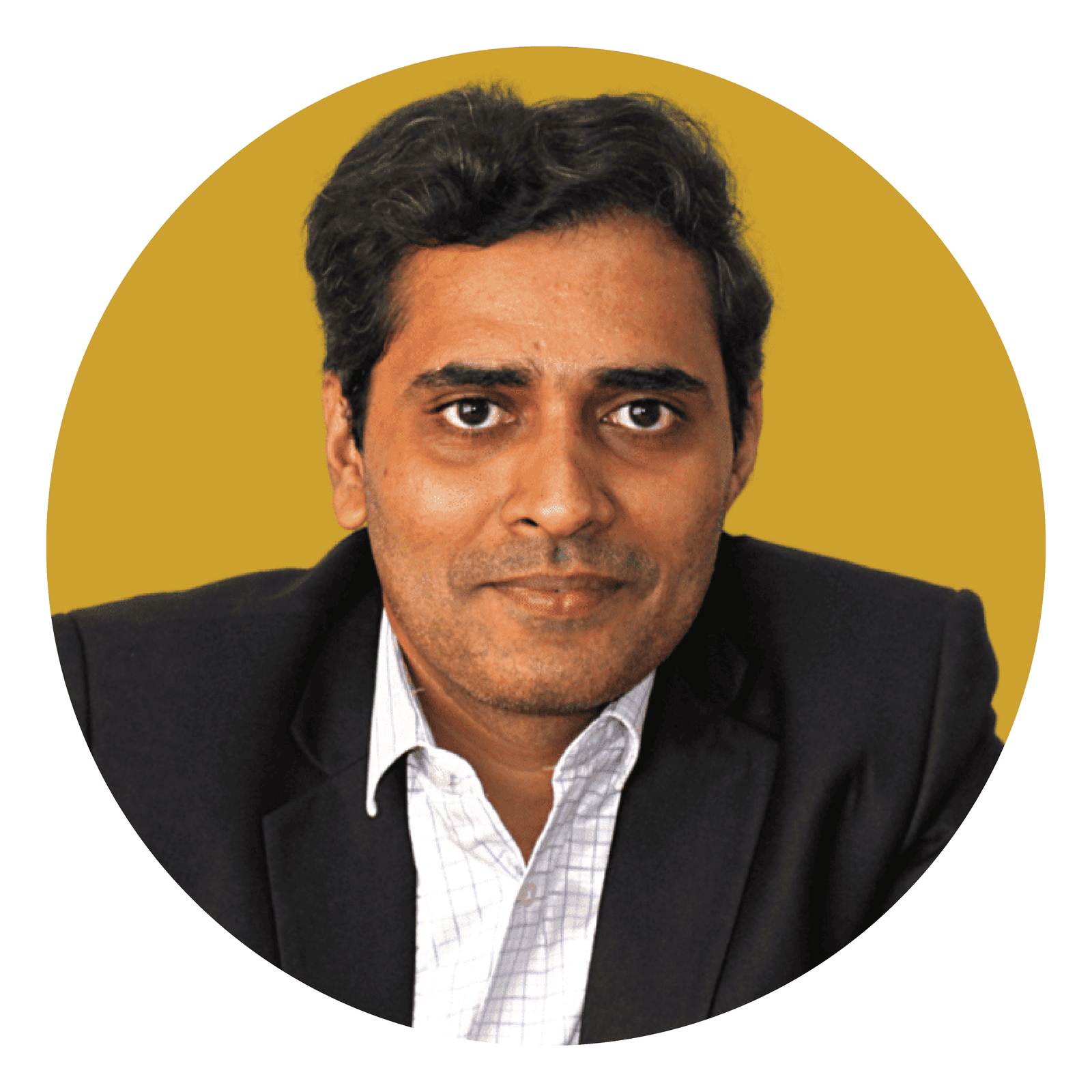

Siju Nair

Siju Nair

Rajiv and I have known one another since our early days in banking. Rajiv has always been a studious, methodical advisor to our clients and the one person I can turn to for help of any sort. If you don’t find Rajiv working at the office, you might find him catching up on the latest in football, cars, and all things technology. Also, he’s the better cook. And I, the better singer.

Rajiv Nair

Siju and I have known one another since our early days in banking. Siju has always been a hardworking cofounder, a knowledgeable advisor, but more a kind, humble friend to me. If you don't find Siju working at the office, he might be on course to become the next Buddha at a Vipassana session.

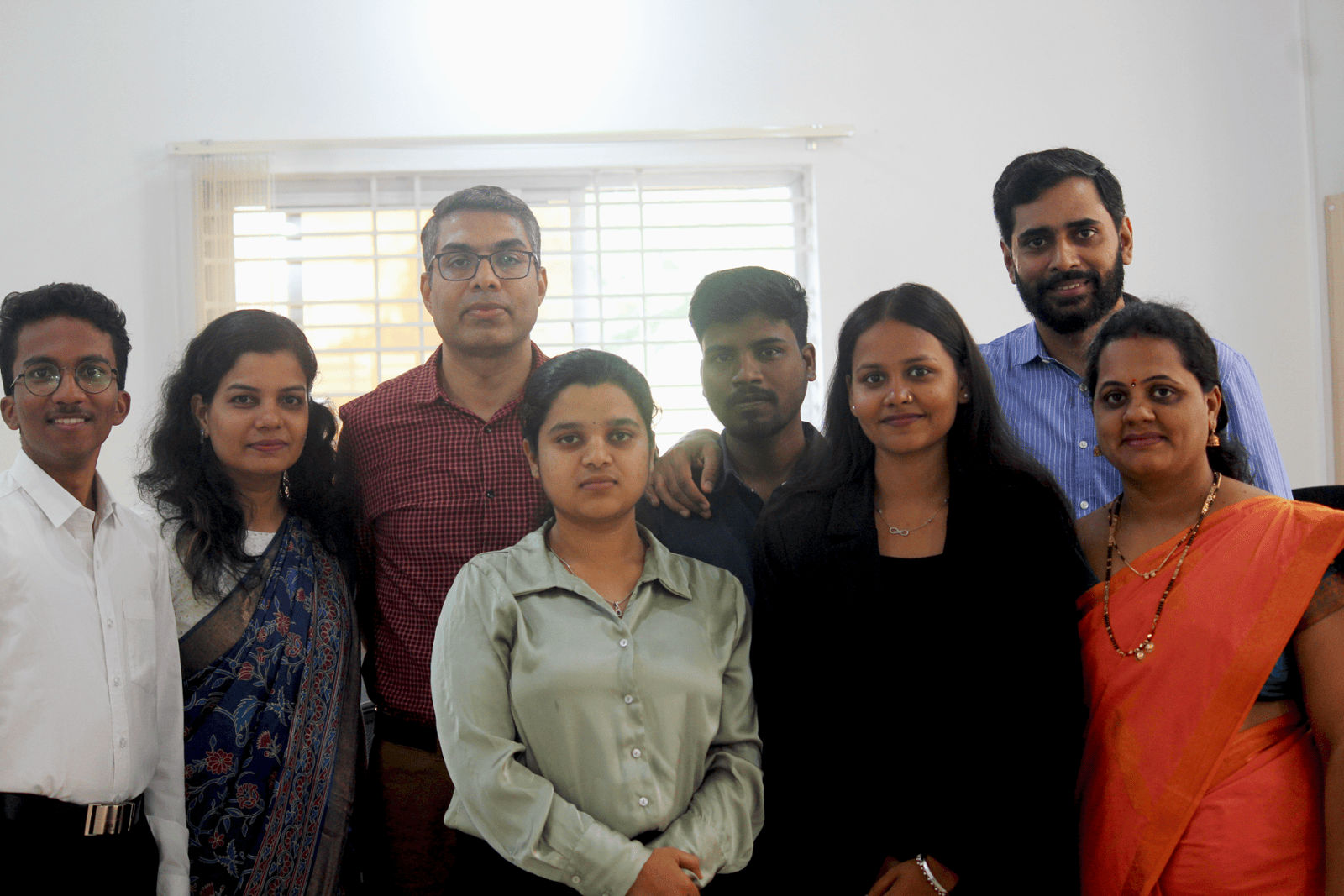

We are a close-knit team of 10 people. Most of us have been working at DocWealth since the firm's inception. We are a pleasant and driven group of people. Our mission to assist clients in reaching their financial freedom unites each of our strengths.

Our proven three-step plan